Simple interest loans calculate curiosity solely on the principal steadiness, while amortized loans have funds that cover each interest and principal. This comparison clearly reveals how choosing a shorter time period or making additional funds can dramatically cut back your total interest prices and construct equity quicker. Extra technically, an amortization schedule is an entire table of all mortgage funds over the whole term.

Suppose you may be considering taking out an amortized mortgage for a long-term investment or a significant purchase. In that case, you want to understand how rates of interest can impression your finances sooner or later. For instance, if the interest rates are anticipated to go up in the future, you may want to think about locking in a fixed-rate mortgage now to keep away from greater interest rates later. A mounted interest rate is a fee that is still constant throughout the life of the loan. This implies that the borrower will pay the same amount of curiosity every month, no matter changes out there or the lender’s insurance policies. Fixed interest rates are sometimes preferred by debtors who want to have a predictable payment schedule.

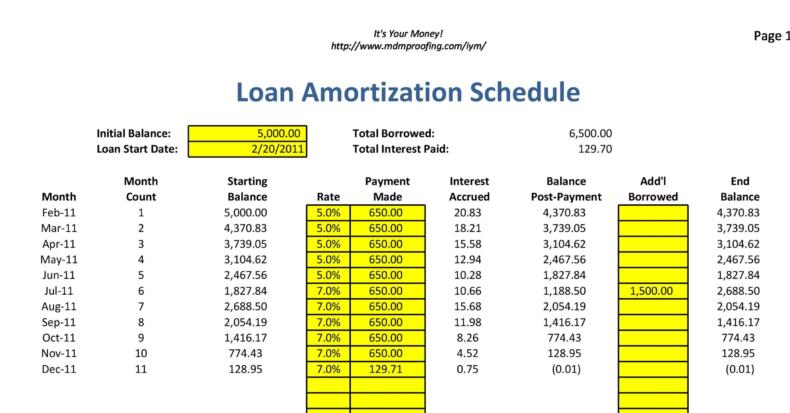

Both method, understanding how every option affects amortization helps you make smarter, more knowledgeable monetary selections. An amortized mortgage has a front-load interest construction, which is another method of claiming that debtors should pay a big quantity of interest before they begin chipping away at the principal. With an amortized loan, part of each mounted cost covers the interest, and the rest reduces the principal. The curiosity on an amortized mortgage is calculated based on the latest ending balance of the loan.

Fixed Vs Variable Price Loans: How They Have An Result On Amortization

As interest rates fall, hundreds of thousands of debtors may find a way to refinance and get extra inexpensive funds. A discount in rate from 7.25% to six.5% would lead to a $200 month-to-month financial savings on a $400,000 mortgage with an analogous time period. If rates of interest fall to five.5%, greater than 7 million borrowers can potentially refinance, and over 5 million of these refi candidates received their mortgages prior to now three years. When considering the panorama of loans, rates of interest play a pivotal position in shaping the financial obligations of debtors. These rates usually are not uniform throughout totally different mortgage types; they range significantly, reflecting the extent of danger, loan period, and market conditions.

This permits companies to not only profit from a fixed installment amount but in addition ensures that they successfully pay curiosity throughout the mortgage length or the amortization interval. An amortization desk shows the calculations of an amortized loan, listing related balances and greenback amounts for every period. The principal quantity paid in the interval is applied to the outstanding loan steadiness. Subsequently, the present mortgage balance, minus the principal quantity paid in the period, results in the new outstanding mortgage balance, which is used to calculate the curiosity for the next period. Savers will be getting much less of a bang for their buck as the Fed drops rates of interest. While monetary institutions are usually sluggish to decrease the charges they charge borrowers, they’re faster to drop the rates on financial savings accounts and certificates of deposit.

This refers to the process of paying off your mortgage over time, sometimes via a collection of standard payments. While it may sound easy, there are actually numerous elements that may influence how your mortgage is amortized, and understanding these components is key to making sensible financial selections. The principal, or the preliminary quantity you borrow, plays a significant position in your amortization schedule. A bigger loan typically leads to greater month-to-month payments and extra curiosity paid over time, assuming all other factors stay fixed. Even a small difference in interest rates can significantly impression the whole price of your loan.

- The benefits are that when you need the additional cash when you’re first taking out your mortgage, you are paying much less in the monthly payment.

- It can include prices similar to application fees, origination charges, and prepayment penalties that will offset the potential financial savings.

- In the early years of the mortgage, a larger portion of your cost goes towards interest.

- This refers to the strategy of paying off your mortgage over time, typically through a collection of normal payments.

- This structured strategy helps you understand precisely where your money goes with every cost.

Factors Affecting Amortization And Cost

Curiosity rates are more than simply numbers; they seem to be a reflection of the economic setting and a key think about private financial planning. By grasping how they work, individuals can make informed selections that align with their monetary targets and circumstances. Fiscal insurance policies are government interventions in the economic system and may directly affect the value of borrowing cash. If the government is printing money or growing taxes to assist stimulate the economy, then rates of interest might rise.

On the opposite hand, variable interest rates can fluctuate with market situations, which implies your payments can range over time. While this poses a danger of higher funds, it also presents the potential for decrease curiosity costs if charges decline. In the tip, choosing the proper amortization period on your variable price mortgage is all about discovering the best balance between month-to-month funds and long-term prices. By taking the time to contemplate your choices and crunch the numbers, you may make a choice that’s best for you and your monetary goals. Total, there are a number of elements to contemplate in relation to amortization in variable rate mortgages. By understanding these elements, you can make informed choices about your mortgage and make sure that you’ll find a way to sustain together with your month-to-month payments.

The bulk of early funds goes toward curiosity while the majority of later payments goes towards the principal. Curiosity rates play a pivotal position within the monetary world, influencing every thing https://www.simple-accounting.org/ from the financial system at massive to the individual funds on a home mortgage. They are basically the value of borrowing cash, expressed as a percentage of the amount borrowed.

This development continues over the 120-month period till the loan — interest and principal quantity — is paid again in full. For businesses seeking to streamline money circulate administration, manage debt, and build higher budgets, it’s crucial to look at mortgage compensation schedules. Variable rates of interest, on the other hand, fluctuate over time based mostly on market situations. This implies that the borrower’s interest rate can go up or down all through the lifetime of the mortgage.